Should I buy a new or used car or keep my old one?

Should I buy a new or used car or keep my old one?

Should You Buy a New or Used Car, or

Keep Your Old One?

In the United States, one of the most significant drains on personal wealth is the car sitting in

your driveway. It’s not just the immediate cost of a vehicle—financing, depreciation,

maintenance, and insurance all add up to enormous lifetime expenses. Yet, many of us continue

to trade up to new cars, trying to keep up with societal expectations and indulging in the allure of

that “new car smell.”

This blog dives deep into the true costs of new cars, used cars, and maintaining your current

vehicle. By the end, you’ll have a clear picture of how each choice impacts your wallet, lifestyle,

and long-term financial well-being—and why cars are often the main culprit sabotaging

retirement savings.

The True Cost of Vehicle Ownership: Breaking it Down

When considering whether to buy a new, used, or keep your old car, it’s essential to understand

the “true cost to own” (TCO). Edmunds.com offers a helpful calculator to assess the full

financial impact of owning a vehicle over five years, considering everything from maintenance

and taxes to depreciation and insurance. For this exercise, I’ll walk you through several

examples to illustrate the financial outcomes of each option.

Scenario 1: A New 2024 Kia vs. A 2020 Kia

Let’s first take a Kia, a relatively affordable and reliable car. The numbers below reflect data

from Edmunds’ True Cost to Own tool.

● New 2024 Kia

○ Total Cash Price: $28,170

○ True Cost to Own (TCO) over 5 years: $42,800

○ Average Annual Mileage: 15,000 miles (or 75,000 miles over 5 years)

○ Per-Mile Cost: 80¢ per mile

● Used 2020 Kia (with 75,000 miles)

○ Purchase Price: $18,000

○ TCO over 5 years: $31,200

○ Per-Mile Cost: 62¢ per mile

Key Takeaways:

● The new Kia costs 80¢ per mile, while the used 2020 model costs 62¢ per mile.

● On paper, a used car seems more economical. But it’s important to consider that a 2020

Kia with 75,000 miles already has some wear and tear—so why did the previous owner

sell it? Likely because it needed maintenance.

Scenario 2: A New 2024 Ford F-150 vs. A Used 2020 Model

Next, let’s consider a pickup truck—a Ford F-150. Trucks are especially popular, but they carry

significantly higher costs.

● New 2024 Ford F-150

○ Cash Price: $53,000

○ TCO: $64,000

○ Per-Mile Cost: $1.38 per mile

● Used 2020 Ford F-150

○ Purchase Price: $30,000

○ TCO: $51,888

○ Per-Mile Cost: 93¢ per mile

Key Takeaways:

● The per-mile cost of a new F-150 is a staggering $1.38, compared to 93¢ per mile for a

used one.

● Even the used truck is expensive! These high numbers reflect not just the purchase price

but also insurance, repairs, and depreciation.

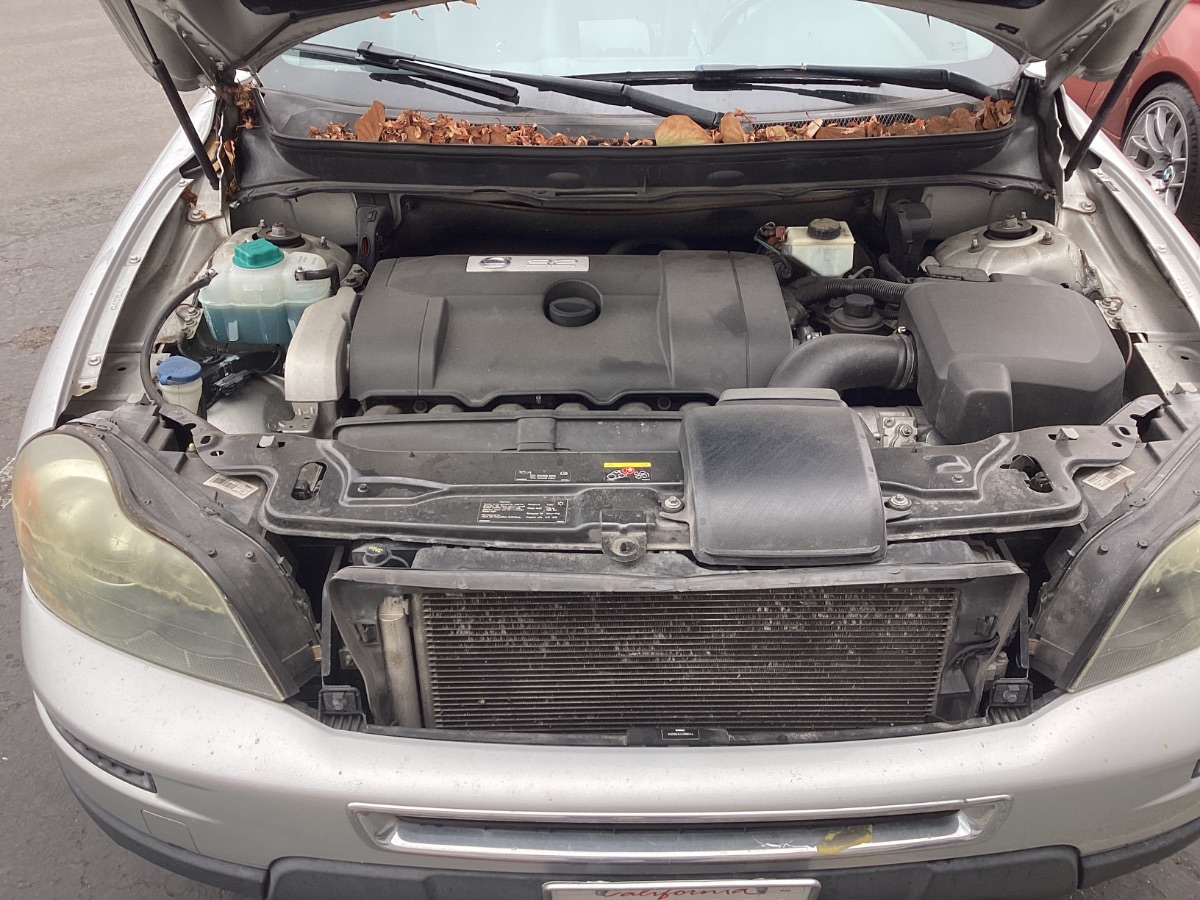

The Economics of Keeping Your Current Vehicle

Let’s shift gears and look at the cost of keeping your current vehicle and properly maintaining

it.

● Bringing Your Vehicle Up to Speed

○ Estimated Repairs & Upgrades: $3,000 (e.g., brakes, shocks, fluids, tires)

○ Ongoing Maintenance Cost: 24¢ per mile

If you maintain your old car correctly, the costs drop dramatically. At 24¢ per mile, the savings

are undeniable compared to both new and used options. That means driving the old car would

cost:

● 24¢ per mile x 75,000 miles = $18,000 over 5 years

● In comparison: A new Kia costs $42,800 over the same period.

Why New and Used Cars Destroy Your Retirement Fund

The real financial danger with vehicles lies not just in the sticker price, but in how easily we

justify spending money on them. We convince ourselves that a newer car is safer, more reliable,

or necessary to keep up appearances, but those justifications come with a significant financial

cost.

Here’s why buying a new car or even a relatively new used one harms your finances:

- Depreciation Is Inevitable

A new car loses 20-30% of its value within the first year. By the end of five years,

you’ve lost 50-60% of what you initially paid. Depreciation is money that could have

gone toward your retirement savings. - Financing Costs Add Up

With high-interest rates, especially in today’s market, financing a car means you pay

thousands more in interest. Even a “cheap” financing deal locks you into years of

payments. - Insurance and Taxes

New cars typically have higher insurance premiums and tax obligations. While these

costs might seem minor, they add up over time. - The ‘Keeping Up with the Joneses’ Mentality

Many Americans feel pressured to drive new, fancy cars to project an image of success.

This leads to a vicious cycle where people continually upgrade their vehicles instead of

building wealth.

A New Car vs. A House: The Depreciation Trap

One argument often heard is, “You pay for a car to use it, just like you pay for a house to live in.”

But here’s the difference: houses typically appreciate, while cars only depreciate. When you

buy a house, you’re investing in an asset that may grow in value. In contrast, the car you buy

will never increase in value—you’re simply paying for the privilege to drive it.

The Smartest Move: Maintain Your Old Vehicle and Build

Wealth

If you’re serious about financial freedom and a comfortable retirement, the best option is to

keep your current vehicle and maintain it properly. Here’s how:

- Invest in Maintenance:

Pay for regular oil changes, tire rotations, and fluid flushes. Keep your car in good

shape, and it will serve you well beyond 75,000 miles. - Find a Reliable Mechanic:

Build a relationship with a trustworthy mechanic who can help you stay on top of repairs.

Preventive maintenance can save you thousands in future repairs. - Reallocate Your Savings:

Instead of making car payments, invest that money into your retirement accounts or

vacation savings. Even a modest $400/month car payment, invested over 30 years,

can grow into a six-figure retirement fund.

Final Verdict: The Cost of Freedom

The numbers don’t lie. Keeping your old car and maintaining it is far more economical than

buying new or used. While it might feel rewarding to drive a new car, the long-term cost is

enormous—and that’s money you could be saving for retirement, vacations, or building your

dream home.

In today’s economy, every dollar matters. Don’t let cars be the reason you fall short of your

financial goals. Break free from the endless cycle of new car purchases, maintain the vehicle

you already own, and invest in what truly matters—your future.